Renters Insurance in and around Tyler

Welcome, home & apartment renters of Tyler!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Tyler Renters!

No matter what you're considering as you rent a home - internet access, size, number of bathrooms, house or apartment - getting the right insurance can be valuable in the event of the unexpected.

Welcome, home & apartment renters of Tyler!

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

When the unpredicted tornado happens to your rented space or townhome, often it affects your personal belongings, such as a smartphone, a cooking set or a desk. That's where your renters insurance comes in. State Farm agent Taylor Berumen is passionate about helping you understand your coverage options so that you can insure your precious valuables.

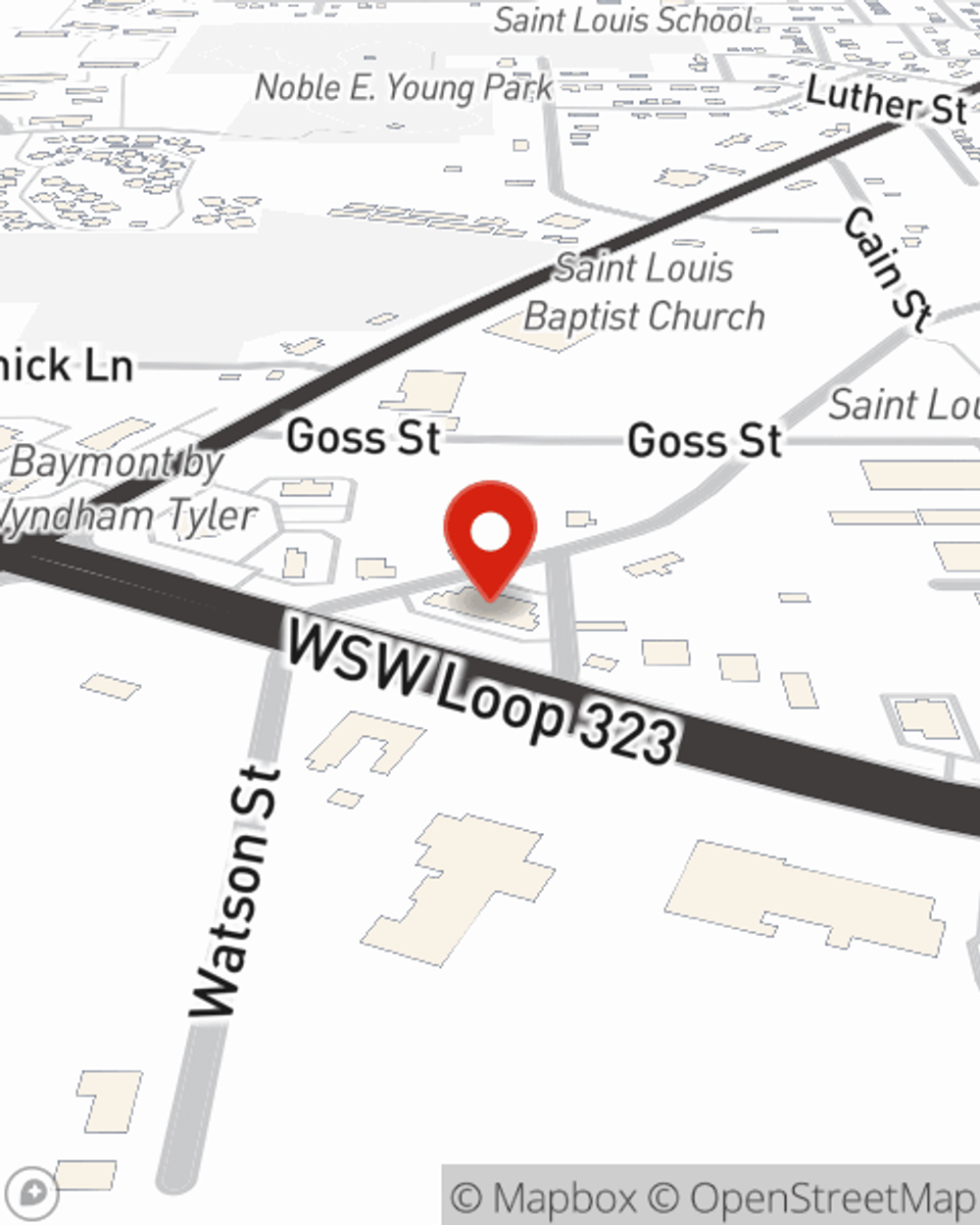

Visit State Farm Agent Taylor Berumen today to explore how a State Farm policy can protect your possessions here in Tyler, TX.

Have More Questions About Renters Insurance?

Call Taylor at (903) 939-3535 or visit our FAQ page.

Simple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Taylor Berumen

State Farm® Insurance AgentSimple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.